| Review Article | UDC: 339.72.053-044.57(497.11) |

Nenad Janković1, Božidar Čakajac1*, Stevan Luković1, Mirela Mitrašević2

1University of Kragujevac, Faculty of Economics, Kragujevac, Republic of Serbia

2University of East Sarajevo, Faculty of Business Economics Bijeljina, Bosnia and Herzegovina

Abstract: The importance of the tourism sector for the successful functioning of the national economy differs considerably from one country to another. Economic research has mainly dealt with the impact of tourism on economic growth, development and employment. The subject of this paper is an examination of the tourism sector as a possible factor in reducing the balance of payments deficit in the Republic of Serbia. The goal of the research is to find out to what extent the tourism sector can contribute to the correction of the disequilibrium in balance of payments of the Republic of Serbia. Secondary data analysis, comparative methods and correlation analysis were used in the research. The results of the research indicate that the decline in imports of tourist services, due to the change of direction of domestic tourist demand, can have a positive effect on the reduction of the current account deficit and, consequently, the balance of payments deficit in the Republic of Serbia.

Keywords: tourism, tourist services, balance of payments, current account deficit, the Republic of Serbia

JEL classification: Z39, F30

Sažetak: Značaj sektora turizma za uspešno funkcionisanje nacionalne ekonomije značajno se razlikuje od zemlje do zemlje. Fokus ekonomskih istraživanja u prošlosti uglavnom je usmeren ka ispitivanju uticaja turizma na ekonomski rast, razvoj i zaposlenost. Predmet rada bazira se na ispitivanju značaja sektora turizma kao mogućeg faktora smanjenja deficita platnog bilansa Republike Srbije. Cilj istraživanja je da se utvrdi u kojoj meri sektor turizma može doprineti uravnoteženju platnog bilansa Republike Srbije. U radu su korišćene analiza sekundarnih podataka, kao i komparativna metoda i korelaciona analiza. Rezultati istraživanja ukazuju da smanjenje uvoza turističkih usluga, kao rezultat preorijentacije domaće turističke tražnje, može pozitivno uticati na smanjenje deficita tekućeg računa, a samim tim i deficita platnog bilansa u Republici Srbiji.

Ključne reči: turizam, turističke usluge, platni bilans, deficit tekućeg računa, Republika Srbija

JEL klasifikacija: Z39, F30

The tourism sector, as an integral part of the economic system, plays a significant role in the functioning of national economies. The importance of tourism in stimulating economic development is reflected in the fact that it contributes to the increase of production and employment, but it can also play a part in improving the balance of payments (BoP) as well. Given that many developing countries are experiencing persistent BoP annual deficits, tourism could be an important factor in improving the service trade balance as an important component of the overall BoP. By attracting foreign tourists and increasing their consumption of domestic products and services, the state increases the so-called “invisible export”. At the same time, the state can stimulate the reorientation of domestic tourist demand from foreign to domestic tourist destinations, which reduces “invisible imports”, that is, the consumption of domestic tourists in other countries.

Regarding the contribution of tourism to the BoP deficit reduction, this impact varies significantly from country to country, although some general conclusions can be applied. The contribution of tourism in financing the BoP deficit is most significant in countries that attract a great number of tourists, as is the case with the Mediterranean countries, where tourism generates high revenues. However, tourism can be an important factor in improving the BoP in both developed and developing countries. As for the Republic of Serbia (RS), the tourism sector is far less important for the national economy in comparison to countries reliant on tourism. Regardless of that, tourism certainly plays a significant role in the economic development of the RS, which is also the main motive for examining its potential to reduce the BoP deficit in the RS.

The importance of the tourism sector in improving the BoP in the RS has become noticeable in 2020 and 2021 when the surplus in tourist service trade was recorded for the first time. Hence, the main research contribution of the paper is reflected in highlighting the potential of tourist service trade surplus to offset the BoP deficit in the RS, given that the presence of the tourist service trade deficit from 2007 to 2019 adversely affected the current account (CA) balance and the BoP. Also, to the best of the authors’ knowledge, the relation between the tourist service trade and the BoP financing has not been previously studied in the RS.

The paper is organized as follows. After the introduction, the second part of the paper presents an overview of relevant research that analyzed tourism as a factor in improving the BoP. In the third part, a description of the data and methodology used in the paper is provided. The fourth part of the paper is devoted to research results and discussion. In the last part, appropriate conclusions are drawn.

2. Literature overview

Researchers have examined the impact of tourism on the economic performance of individual countries from different perspectives, but predominantly their focus was on the impact on economic growth, GDP and employment. Regarding economic growth, Dritsakis (2004), on the example of Greece, proved the existence of the long-term relationship between tourism and economic growth. Similar conclusions were reached by Balaguer and Cantavela-Jorda (2002), on the example of Spain, who also confirmed the relationship between tourism income and economic growth in the long term. The indirect impact of tourism on economic growth is achieved through triggering other complementary activities, such as the hotel industry, retail and wholesale, transportation, agriculture and others. Apart from the positive impact on economic growth, tourism has a positive impact on employment and job creation (Soukiazis & Proenca, 2008).

The impact of tourism on the BoP began to attract the attention of researchers over the last couple of decades. Hundt (1996) was among the first researchers to point out the positive contribution of the tourism sector in correcting disequilibrium in the BoP. The existence of a positive impulse of the tourism sector in financing the CA deficit in the case of Barbados was confirmed by Lorde et al. (2010). Recent research also confirms the role of the tourism sector as a factor in improving the BoP and financing the CA deficit. Ongan (2008) confirmed the growing importance of the tourism sector in financing the CA deficit in Turkey, and identical conclusions were reached by Cetintas and Bektas (2008), Arslanturk and Atan (2012), Alp and Gene (2015), as well as Cihangir et al. (2014). Celik et al. (2013) found that the increase in tourism income in the period from 1984 to 2012 influenced the reduction of the BoP deficit in Turkey by 14%.

Recently, Santacreu (2016) has investigated the impact of tourism sector on China's CA balance in the 2000-2015 period. China recorded a continuous CA surplus since 2000, which means that the Chinese economy stands as a net lender to the rest of the world. The author concludes that a positive goods trade balance played a key role in maintaining the CA surplus in China. When it comes to the services trade balance, Santacreu (2016) concluded that the services exports were equal to imports from 2000 to 2007, after which an increase in the service trade deficit occurred. By the end of 2015, the service trade deficit accounted for approximately 1.7% of China's GDP. The tourism sector was a major factor that triggered the increase in the service trade deficit, since the import of tourist services surpassed the exports starting from 2015. As a consequence of the increase in the deficit of tourist services, the CA deficit of China recorded a slight growth at the end of the observed period despite the presence of goods trade surplus.

The role of tourism sector in improving the BoP has also been recognized by the World Tourism Organization (UNWTO). In the publication dedicated to global tourism trends in 2019, UNWTO (2020) pointed out that tourism revenues have the potential to reduce the service trade deficits in many countries, which improves the BoP. The 2019 data revealed that among the countries with the highest tourist services trade surplus there were highly developed economies, such as the United States, France, Italy, Spain, France, but also developing countries, such as Thailand, Macau, Mexico, Malaysia, Dominican Republic and Morocco. The above once again confirms the importance of the tourism sector in improving the BoP in both developed and developing countries.

Gidey (2021) observed the impact of tourism sector on offsetting the CA deficit on the example of Ethiopia. In order to determine the existence of the causality relationship between tourist service trade and the CA deficit the author implemented ARDL methodology and the Granger causality test. Gidey (2021) came to the conclusion that tourism sector positively affects the CA balance in Ethiopia and tourism revenues could serve as an alternative means of minimizing Ethiopia's CA deficit. Rafiq et al. (2021) investigated the asymmetric impact of tourism sector on the BoP deficit in Pakistan. The research covered the period from 1995 to 2019 and the ARDL model was used. The authors confirmed the asymmetric relationship between tourism and the persistent BoP deficit. Namely, as a result of positive changes in the tourist service trade balance, the BoP deficit decreased by 27%, while negative changes in the tourist service trade balance led to an increase in the CA deficit by merely 2.3%.

When focusing on Western Balkans, it can be stated that tourism plays an important role in reducing the BoP deficit. Thano (2015) found that tourism sector is the most important in the export of services in Albania. In the 2004-2013 period, the export of tourist services accounted for 60% to 80% of the total export of services. However, the rapid growth of the outflow of Albanian tourists abroad reduced the effect of the tourism sector on the Albanian BoP. The outflow of funds due to the import of tourist services in 2013 increased by 115.7% compared to 2004. When looking at Montenegro, it can also be said that it is an economy reliant on tourism. This reliance is particularly evident in financing the CA deficit. Due to its high dependence on imports, Montenegro suffers from a chronic CA deficit, and the tourism sector significantly contributes to its reduction. Research conducted by Veličković and Tomka (2017) indicates that in the 2005-2008 period, the tourism sector did not have an impact on CA deficit financing in Montenegro, since despite the increase in tourism income, an increase in deficit was recorded. However, in the 2009-2014 period, the increase in tourism revenues had a positive effect on the reduction of the CA deficit. The authors concluded that from 2005 to 2008 an increase in tourism revenues of one million euros would result in an increase in the CA deficit of 3.40 million euros. On the other hand, when looking at the 2009-2014 period, an increase in tourism revenues of one million euros would reduce the CA deficit by 1.95 million euros. Also, Albania and Montenegro were included in research conducted by Bacović et al. (2020), which analyzed the short-term and the long-term impact of the export of tourist services on the CA balance and economic growth in Mediterranean countries in the 1998-2018 period. The authors found that tourist services had a more significant impact on CA balance dynamics compared to other types of services in Mediterranean countries.

3. Data and methodology

Secondary data collected by the National Bank of Serbia (NBS, 2022) as part of external economic statistics were used in the paper. For the research period the 2007-2021 period was taken, considering that in this period the BoP methodology in RS was harmonized with the methodology of the International Monetary Fund (2009) for the preparation of the BoP (BPM6 – BoP and International Investment Position Manual, Sixth Edition). As the initial year of the observed period 2007 was chosen, given that in the period before 2007, the BoP methodology in RS was harmonized with the previous IMF methodology – BPM5 (NBS, 2006). The data used in the analysis refer to the CAD, service trade balance, as well as the export and import of tourist services.

The methodological approach used in the paper is based on quantitative analysis, with the primary goal of examining the impact of the tourist service trade balance on the CA deficit in RS. The secondary data analysis, comparative analysis and correlation analysis were carried out in the paper. In order to indicate the importance of service trade balance in financing the CA, secondary data analysis is used. A comparative analysis was used to assess the role of the tourism sector in comparison to other components of the service trade account in achieving the service trade surplus, and, consequently, in reducing the CA deficit. Correlation analysis was used to examine the relation between the tourist service trade and the CA deficit in the observed period.

The main research hypotheses examined in the paper are:

H1: The tourist service trade balance affects the reduction of the CA deficit in the RS.

H2: The Covid-19 pandemic has contributed to the increase of the tourism sector’s impact on improving the BoP in the RS.

4. Results and discussion

This part of the paper presents the results of the analysis of the tourism sector’s contribution to improving the CA deficit in the RS. In order to conduct a comprehensive analysis of the importance of the tourism sector as adequately as possible, the composition of the service trade account is first shown, considering that the effects of the tourism sector on the CA are directly manifested through the service trade account. In Section 4.1. the decomposition of the services account was carried out to determine the role of the tourism sector in comparison with other components of this account and ultimately show the role of the service trade account in financing the CA deficit. The contribution of tourism sector to minimizing the CA deficit is analyzed in Section 4.2.

4.1. Export and import of services and the CA deficit

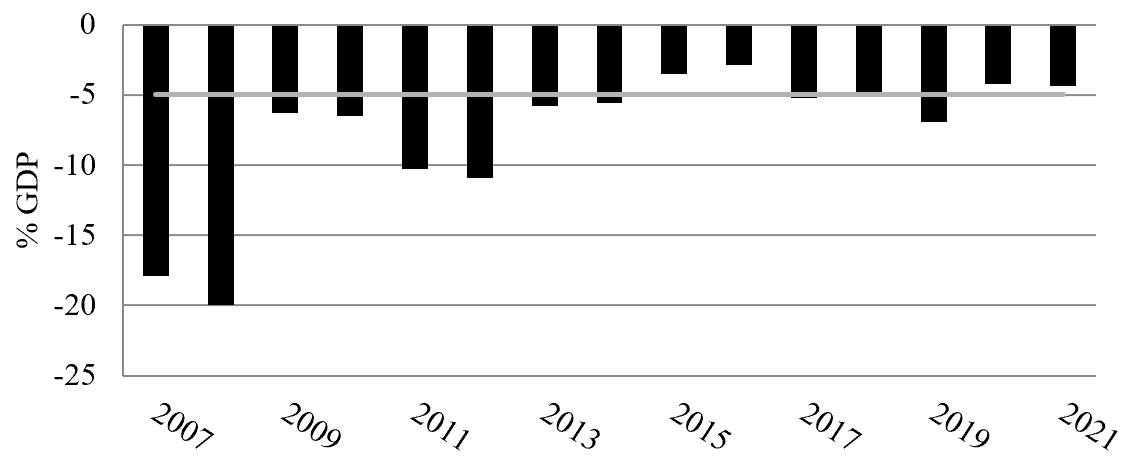

The BoP in RS is characterized by persistent annual deficits, which are primarily the result of the annual CA deficits (Malović, 2008). Figure 1 shows the CA deficit in the RS in the 2007-2021 period, expressed as a percentage of GDP. The CA deficit fluctuated considerably in the observed period, reaching the highest level in 2008 (over 7 billion euros), while the lowest level of deficit was recorded in 2016 (a little over one billion euros) (NBS, 2022). Although there is no consensus in the economic literature about the acceptable size of the CA deficit, from the aspect of long-term macroeconomic sustainability, a level of up to 5% of GDP is considered sustainable (Janković, 2015).

In most of the observed period, the CA deficit of the RS exceeded 5% of GDP, while in the first two years of the observed period it amounted to 17.8% and 20% of GDP, respectively. In 2015, for the first time, the CA deficit amounted to less than 5% of GDP. Until the end of the observed period, the CA deficit remained at a level of less than 5% of GDP in all years, except in 2017 and 2019 (5.2% and 6.9% of GDP, respectively).

Figure 1: CA deficit as % of GDP of RS in 2007-2021

Source: NBS, 2022

A more thorough analysis of the components of the CA can detect the key factors that impact its dynamics in the observed period. In this sense, changes in the value of the account of export and import of goods and services, as well as the account of primary and secondary income are the main components that can affect the reduction of the CA deficit.

First of all, it should be pointed out that the existing CA deficit is primarily the result of a multi-year goods trade deficit (Knežević & Penjišević, 2021). Also, the primary income account contributed significantly to the CA deficit, primarily due to the growing outflow of income stemming from foreign direct investments (Kovačević, 2020). On the other hand, the increase in services trade surplus and the continuous surplus in the secondary income account led to the gradual decrease in the level of the CA deficit in the observed time period. Secondary income account (primarily remittances from workers from abroad) which recorded a surplus of 4.5 billion euros in 2021 has been a particularly important factor in reducing the deficit (Đekić et al., 2022). Regarding trade in services, there seems to be an increase in its potential for reducing the CA deficit since the trade surplus in services has been rising in the entire observed period (Vemić, 2021).

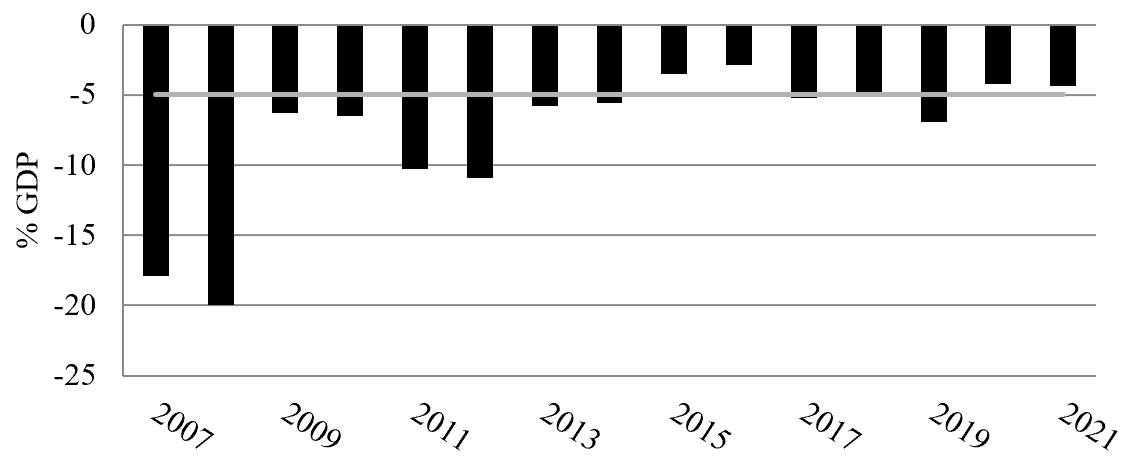

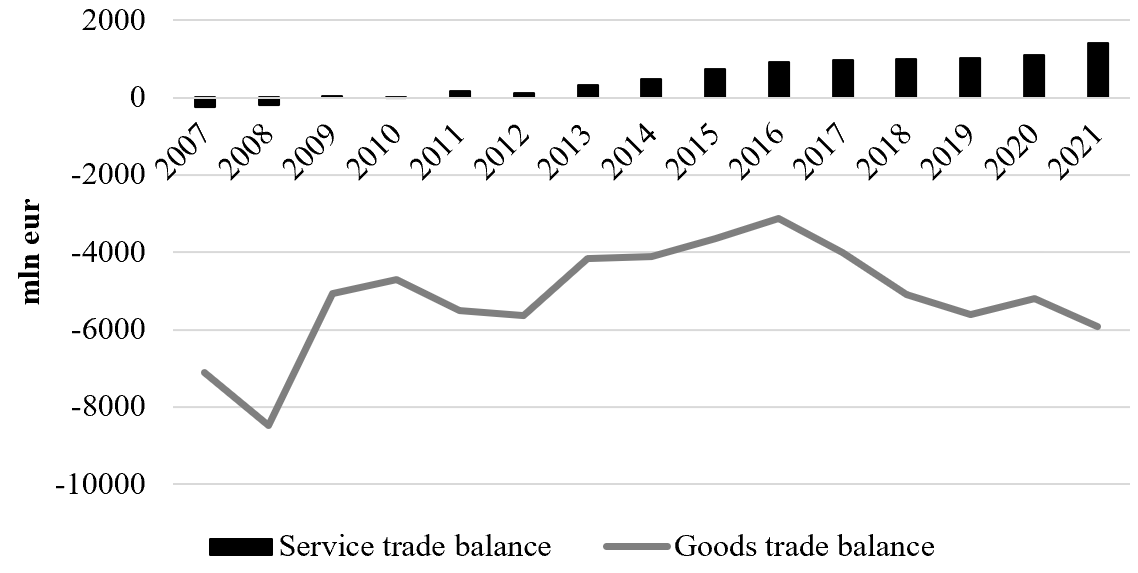

When looking at the trade in services, the trade deficit was recorded in the initial years of the observed period (2007-2010), but from 2011 until the end of the observed period, a continuous increase in the services trade surplus was recorded (Figure 2). The presence of the services trade deficit in the initial years of the observed period was primarily caused by errors made in conducting the economic policy (Marjanović & Marjanović, 2019). However, the surplus reported starting from 2011 was not merely sufficient to completely offset the CA deficit. For example, the services trade surplus amounted to 111 million euros in 2012, while the CA deficit amounted to slightly more than 3.6 billion euros.

The more dynamic increase in service trade surplus since 2015 emphasized its potential in reducing the CA deficit. Thus, in 2015, the services trade surplus was sufficient to finance more than 50% of the CA, while in 2016 the services trade surplus was only slightly lower. However, the upward trend recorded in the CA deficit dynamics since 2017, along with slower growth of the trade surplus in services, resulted in lowering the impact of services trade surplus on financing the CA deficit.

Figure 2: The role of service trade surplus in financing the CA deficit, 2007-2021

Source: NBS, 2022

Nevertheless, it can be said that the trade surplus in services has become an increasingly important factor in reducing the CA deficit. In 2021, the services trade surplus amounted to over 1.4 billion euros, which is almost 10 times more compared to the level reported in 2011. On the other hand, goods trade deficit was recorded in the entire observed period. From 2008 to 2016 the goods trade deficit declined from almost 8.5 billion euros in 2008 to just over 3 billion euros in 2016. However, since 2016, there has been an increase in the trade deficit in goods due to a more dynamic growth of imports than exports.

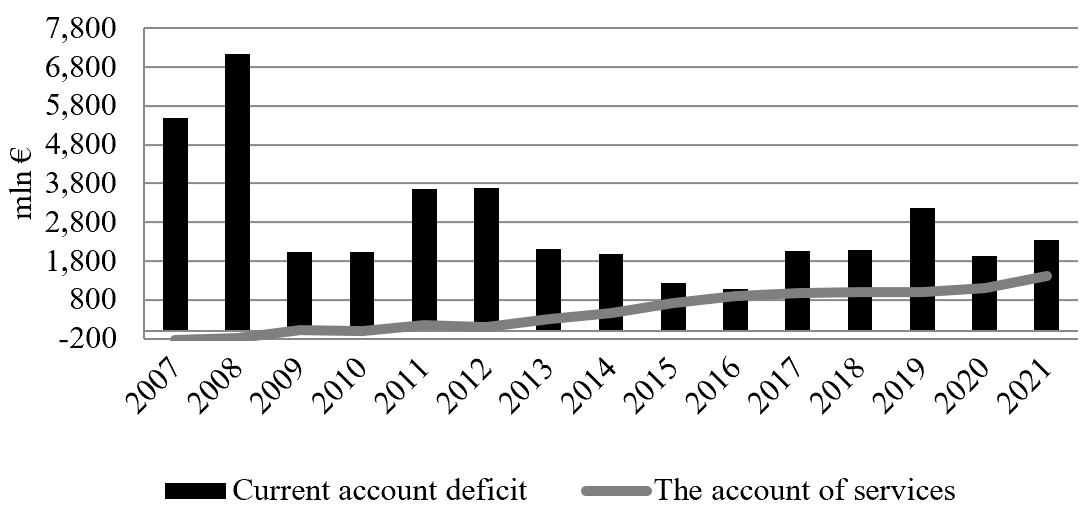

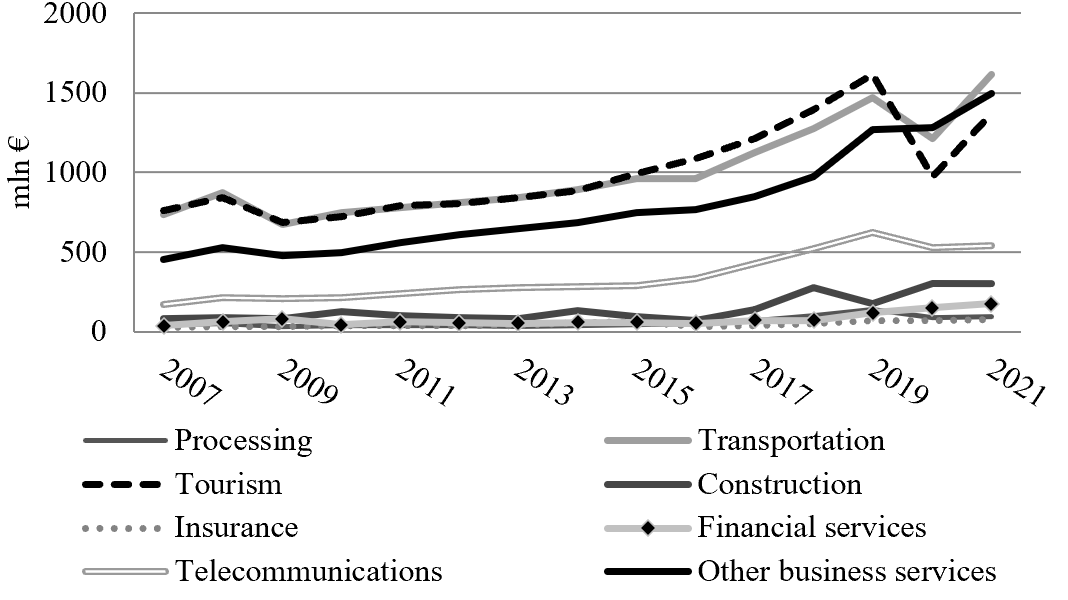

By looking at the export and import of services separately, it can be observed that, on the export side, telecommunication and tourist services are the most important ones. As Figure 3 shows, at the end of 2021, other business services (research and development services, professional and managerial consulting, technical and other services) recorded the largest export in the amount of more than 2 billion euros. Telecommunication services also recorded the upward trend in the observed period.

Figure 3: The export of services in the RS, 2007-2021

Source: NBS, 2022

At the end of 2021, telecommunications were the second largest item on the export side with the value of 1.8 billion euros approximately. The third largest export belonged to tourist services. After the apparent rising trend in the period from 2007 to 2019, a sharp decline in 2020 was recorded due to the Covid-19 outbreak. Transportation services export follows, which at the end of 2021 amounted to approximately 1.3 billion euros. The export of other services groups in the observed period was significantly lower compared to telecommunications, tourism, transport and other business services.

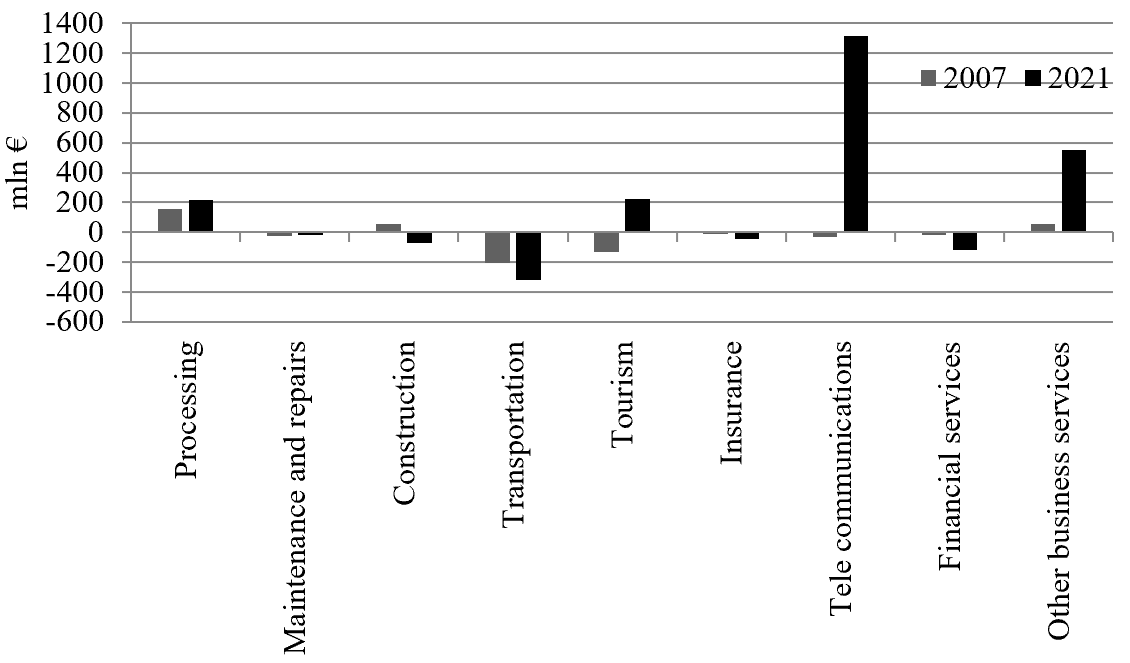

In the structure of import of services, other business services, transport and tourist services dominate. The import of telecommunication services was smaller than the export and amounted to 540 million euros in 2021 (Figure 4). In most of the observed period, tourist services were the most imported ones, but in 2020 a sharp decline was recorded due to the closure of national borders that followed the Covid-19 onset.

Figure 4: The import of services in RS, 2007-2021

Source: NBS, 2022

As can be seen from Figure 5, the increase in the services trade surplus largely contributed to the trade surplus in telecommunications, which significantly increased in 2021 compared to 2007, as well as the trade surplus in other business services. Also, processing and tourist services contributed to the increase in trade surplus, but to a minor extent.

Figure 5: Trade balance for different services groups in the RS, 2007-2021

Source: NBS, 2022

In addition to the services trade surplus and secondary income account as two items that significantly offset the CA deficit, it is very important that the creators of economic policy additionally encourage exports of goods to reduce the goods trade deficit. Also, with an appropriate investment policy government must encourage foreign investors to reinvest the realized profit instead of the current practice of profit repatriation, which would positively affect the primary income account deficit reduction (Kovačević, 2017). The aforementioned measures would ultimately contribute to the deficit reduction.

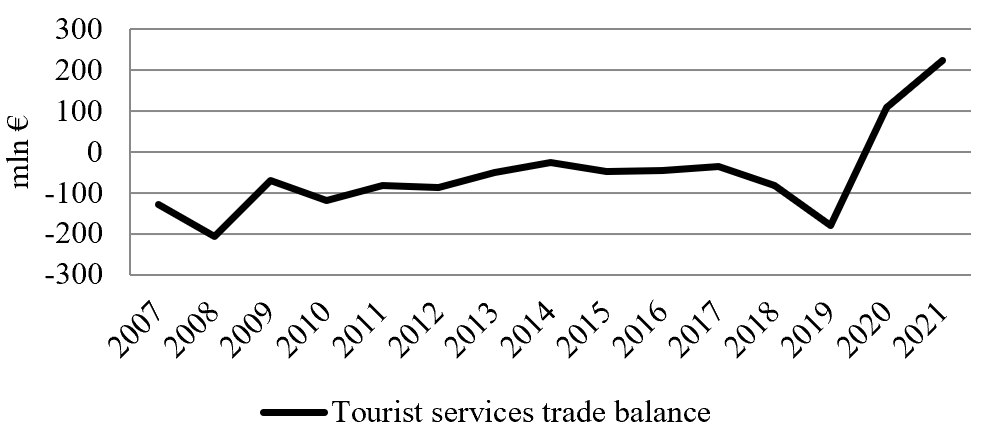

4.2. The role of tourism sector in offsetting the CA deficit

The trade balance in tourist services has shifted from the deficit recorded in 2007 (129 million euros) to the surplus recorded at the end of 2021 (224 million euros). A closer look at the trade balance in tourist services, as shown in Figure 6, reveals that from 2007 until 2019 the trade deficit in tourist services was recorded in every single year (Petrović et al., 2016). The tourist service trade deficit was largest in 2008 (205 million euros), but in the final two years of the observed time period, a surplus was recorded as a result of larger exports to imports of tourist services.

Figure 6: Tourist services trade balance in the RS, 2007-2021

Source: NBS, 2022

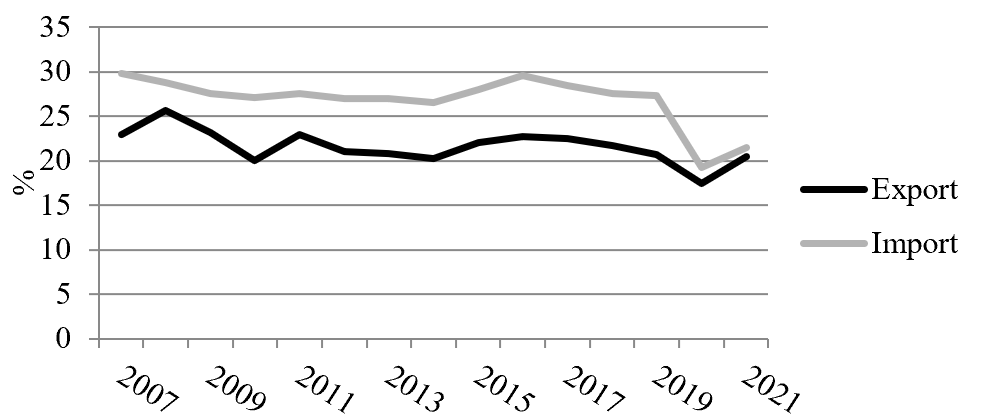

Tourist services have a significant share in both the export and import of services in the RS. In Figure 7, it can be seen that the share of tourist services in the total export of services was approximately 20% in 2021, but it was slightly higher at the beginning of the observed period (25.6% in 2008), which suggests that in addition to the increase in the tourist service exports in the last two years in absolute terms, a further progress can be achieved. More precisely, in the following period, efforts should be made so that the export of tourist services reaches and surpasses the share in the total export of services from the beginning of the observed period.

Figure 7: Import/export of tourist services as % of the overall import/export of services, 2007-2021

Source: NBS, 2022

Given the significant share in the export of services, the tourism sector can particularly contribute to the increase of the trade surplus in services and the reduction of the CA deficit. The condition for tourism to take over this role is that income from foreign tourists spending time in the RS surpasses the income spent by domestic residents abroad. The Covid-19 pandemic has greatly influenced the change of course of domestic tourist demand, in the sense that it forced domestic tourists to spend their vacations in one of the tourist destinations in the country rather than abroad (Bošković et al., 2020). The above resulted in a decrease in the outflow of tourist services and a trade surplus in tourist services.

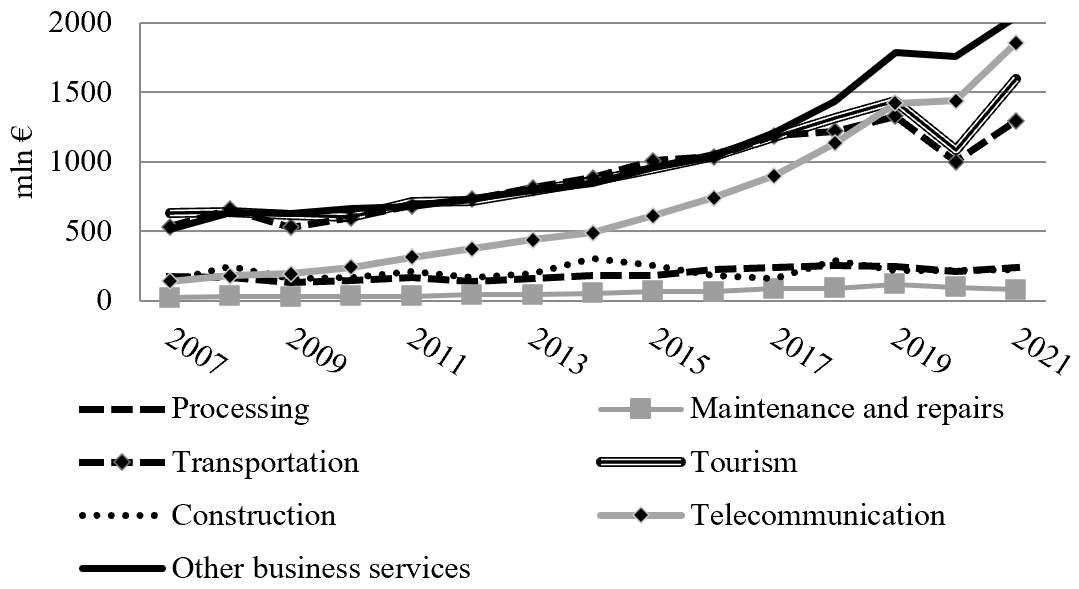

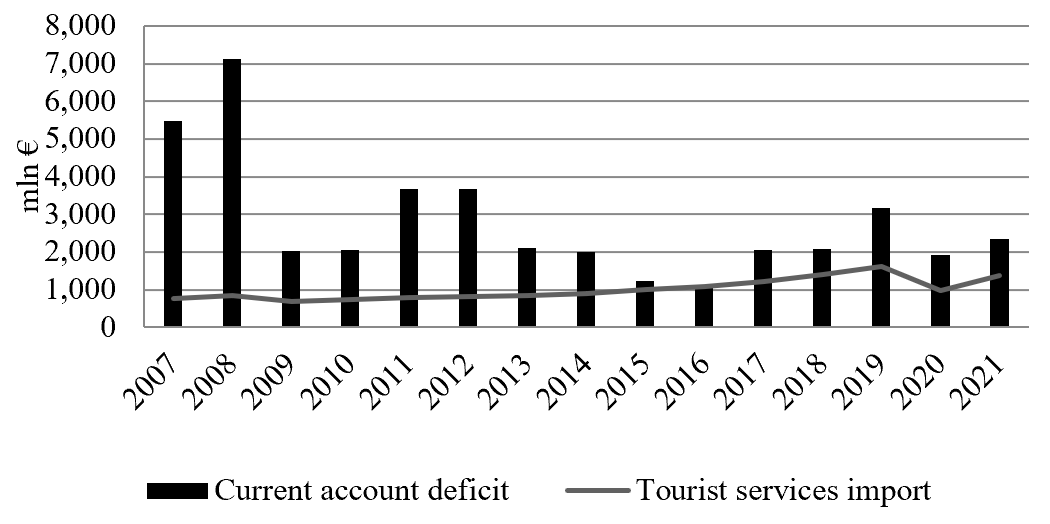

Outflows of funds stemming from domestic tourists spending time in foreign countries negatively affected the CA in the RS. Namely, in the period from 2007 to 2019, the import of tourist services was larger than the export, which resulted in the trade deficit in tourist services. The observed dynamics had a negative impact on the services trade balance and, consequently, the CA deficit. Figure 8 shows the relationship between the import of tourist services and the CA deficit. As can be seen, the size of tourist services import had eventually become much closer to the size of the CA deficit with the passage of time.

In the initial years of the observed time period, the import of tourist services was relatively low compared to the CA deficit. However, starting from 2015 until the end of the observed time period, tourist services accounted for larger share of the CA deficit. In 2016, the import of tourist services was practically equal to the value of the deficit. From 2017 to 2019, imports of tourist services were between 1 and 1.6 billion euros. In 2020, the import of tourist services fell sharply to a level of 975 million euros, while the CA deficit amounted to 1.9 billion euros. Furthermore, in 2021, the CA deficit amounted to 2.3 billion euros, while the import of tourist services amounted to 1.3 billion euros.

Figure 8: Import of tourist services and the CA deficit, 2007-2021

Source: NBS, 2022

In order to examine the contribution of the tourism sector to neutralizing the CA deficit, Table 1 first shows the tourist service trade balance and its share in the CA deficit. In the period from 2007 to 2019, the tourist service trade deficit and the CA deficit were reported in each year, with the largest share of the tourist service trade deficit in the CA deficit recorded in 2010 (5.84%). However, in 2020 and 2021, the tourism sector directly contributed to financing the CA deficit, considering that the tourist service trade surplus was reported in this period. Thus, in 2020, the tourist service trade surplus was sufficient to compensate for 5.65% of the CA deficit, while in 2021 this effect was even greater, since the tourist service trade surplus was sufficient to finance 9.56% of the CA deficit. These dynamics certainly point out to the rising potential of the tourism sector in neutralizing the CA deficit in the RS.

Table 1: Tourist service trade balance and the CA balance, 2007-2021

Year |

Tourist service trade balance (mln EUR) |

CA balance |

Tourist service trade balance as % of the CA balance |

2007 |

-129 |

-5,474 |

2.36 |

2008 |

-205 |

-7,125 |

2.88 |

2009 |

-69 |

-2,032 |

3.40 |

2010 |

-119 |

-2,037 |

5.84 |

2011 |

-81 |

-3,656 |

2.22 |

2012 |

-86 |

-3,671 |

2.34 |

2013 |

-49 |

-2,098 |

2.34 |

2014 |

-26 |

-1,985 |

1.31 |

2015 |

-48 |

-1,234 |

3.89 |

2016 |

-45 |

-1,075 |

4.19 |

2017 |

-35 |

-2,051 |

1.71 |

2018 |

-82 |

-2,076 |

3.95 |

2019 |

-179 |

-3,161 |

5.66 |

2020 |

+109 |

-1,929 |

5.65 |

2021 |

+224 |

-2,343 |

9.56 |

Source: NBS, 2022

Based on the above, it can be concluded that the tourism sector certainly affects the CA deficit, considering that it represents its integral part (Selimi et al., 2017). The impact of tourism sector is manifested indirectly through the service trade balance, where the tourist service trade deficit adversely affects the services trade balance and CA deficit. On the other hand, the trade surplus in tourist services positively affects the service trade balance and the CA balance as well.

Table 2: Correlations between tourist services trade balance, CA balance and service trade balance

|

Tourist service trade balance |

CA balance |

Service trade balance |

|

Tourist service trade balance |

Pearson Correlation |

1 |

.498 |

.648** |

Sig. (2-tailed) |

|

.059 |

.009 |

|

N |

15 |

15 |

15 |

|

CA balance |

Pearson Correlation |

.498 |

1 |

.593* |

Sig. (2-tailed) |

.059 |

|

.020 |

|

N |

15 |

15 |

15 |

|

Service trade balance |

Pearson Correlation |

.648** |

.593* |

1 |

Sig. (2-tailed) |

.009 |

.020 |

|

|

N |

15 |

15 |

15 |

|

**p<0.01 (2-tailed) |

||||

* p<0.05 (2-tailed) |

||||

Source: Authors’ research

From Table 2, it can be seen that a high positive correlation (r=0.648, p<0.01) between the tourist service trade balance and the service trade balance exists in the observed time period. A slightly lower level of positive correlation (r=0.593, p<0.05) is reported between the service trade balance and the CA. Finally, there is a positive correlation (r=0.498) between the tourist service trade balance and the CA balance, but it is not statistically significant. This can be explained by the fact that in the last two years a surplus was recorded in tourist service trade, while at the same time an increase in the CA deficit was recorded.

The surplus in the tourist service trade recorded in the last two years of the observed period contributed to the increase in the service trade surplus. However, the increase in the goods trade deficit recorded in the same time period, shown in Figure 9, more than compensated for the positive effects of the tourist service trade surplus, which resulted in an increase in the CA deficit. Hence, Hypothesis 1 can only be partially confirmed.

Figure 9: Goods trade balance and services trade balance, 2007-2021

Source: NBS, 2022

The annual surpluses in tourist services trade recorded in 2020 and 2021 are primarily the result of the reorientation of domestic tourist demand (Mandarić et al., 2022). The Covid-19 border closures had a positive effect on the tourist service trade balance. In 2020, a decrease was recorded on both the import and the export side of tourist service trade when compared to 2019, but the relative change was larger on the import side. The above can be observed from Table 3, which shows the annual changes in the import and export of tourist services in the period prior to the outbreak and during the Covid-19 pandemic. Looking ahead to 2021, an increase was recorded on both the export and import side, but this time the relative change was larger on the export side.

Table 3: Export and import of tourist services, 2019-2021 (mln EUR)

Year |

Export |

Import |

||

Value |

% change |

Value |

% change |

|

2019 |

1,436 |

/ |

1,615 |

/ |

2020 |

1,084 |

-24.5 |

975 |

-39.6 |

2021 |

1,596 |

+47.2 |

1,372 |

+40.7 |

Source: NBS, 2022

In this way, Hypothesis 2 can be confirmed, given that Covid-19 triggered the occurrence of a surplus in tourist services trade, which created the conditions for the tourism sector to contribute to the reduction of the CA deficit in 2020 and 2021. However, the confirmation is only partial, since the positive effects of the increase in the surplus of the tourist services trade and the services trade as a whole are more than compensated by an increase in the goods balance deficit.

5. Conclusion

The tourism sector, as an integral component of the CA and the services trade balance, can play an important role in reducing the BoP deficit in the RS. By looking back at the period from 2007 to 2021, it can be concluded that the tourism sector has achieved more importance in reducing the CA deficit, but only in the final two years of the observed time period. From 2007 to 2019, the tourism sector contributed to the BoP deficit build up, even though the tourist service trade deficit share in the BoP deficit was of minor importance. However, in 2020 trade surplus in tourist services was recorded for the first time and this was followed by a further annual surplus recorded in 2021. Owing to the recorded surpluses, the tourism sector has become a factor that contributed to reducing the CA deficit.

Although the impact of the trade surplus in tourist services on the BoP deficit is relatively modest in RS, the growing potential of tourism sector in financing the CA should be emphasized. As pointed out in the paper, the services trade surplus has been continuously rising and increasingly contributing to CA deficit financing. Covid-19 border closures have created opportunities for the tourism sector to account for a larger share in service trade surplus dynamics in 2020. A further increase in the surplus in the tourist service trade in 2021 induced the rise of the importance of the tourism sector as a source of financing the CA deficit in the RS.

In order for tourism sector to contribute to financing the CA deficit to a greater extent, it is necessary to encourage the export of tourist services. This implies the reversal of domestic tourist demand that has been primarily focused on foreign tourist destinations. Hence, it is necessary to encourage domestic tourists to spend their holidays in the country, but at the same time create an attractive tourist offer to attract foreign tourists. In this way, the export of tourist services would increase and conditions would be created for achieving continuously growing surpluses in the tourist service trade. In such circumstances, real possibilities would be created for the tourism sector to contribute to the reduction of the CA deficit in the RS.

The main limitation of the research lies in the fact that the positive effects of tourism in financing the CA deficit occurred only in the last two years of the observed period. Despite the growing importance of the tourism sector in financing the CA deficit in 2020 and 2021, the recorded surpluses in tourist service trade are not merely sufficient to eliminate the CA deficit, given that the positive tourist service trade effects are more than compensated by goods trade deficit movements. In the context of future research, it would be useful to include other countries (primarily Western Balkans countries and other transition economies) to compare the importance of tourism sector in reducing the BoP deficit by performing a cross-country analysis.

Conflict of interest

The authors declare no conflict of interest.

References

Received: 13 October 2022; Revised: 7 November 2022; Accepted: 4 December 202